Hello! Alexander Glebov, the algorithmic trader of the AKRA Futures robots cryptocurrency project, is with you again. I present the next monthly report on the work of trading robots. Before the analysis, I want to inform users about our innovation: we have improved the technology of algorithmic trading - we have updated the logic of artificial intelligence. Now the AI filters all the patterns identified by the robots based on historical data and makes a decision on the conclusion of a deal by the robot if the expected profit exceeds the possible losses.

In practice, this led to the fact that robots began to open deals less actively in November, but at the same time the KPI of exchange trading increased. The new technology immediately showed its high efficiency and provided increased profitability at the beginning of the month. This made it possible to smooth out further negative on the cryptocurrency exchange, caused by a series of events that shocked many crypto investors in November.

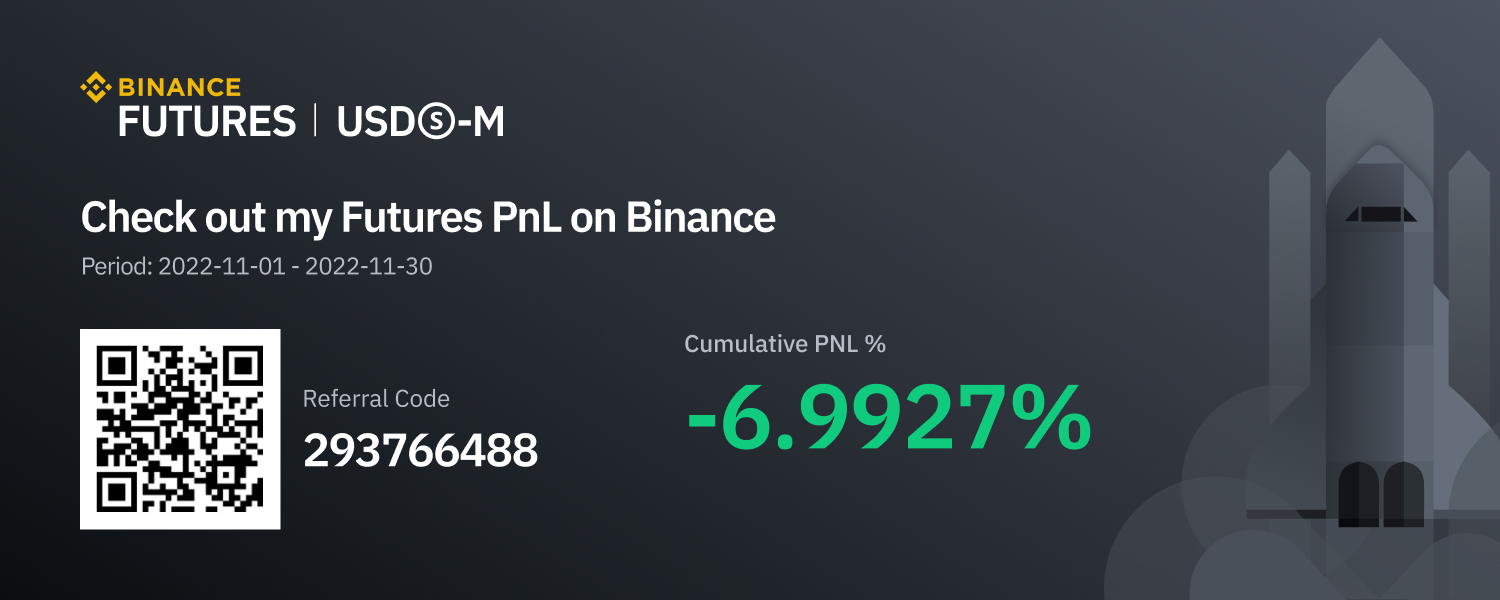

Despite the fact that in November our crypto robots on the Binance exchange showed a loss of 6.9927%, given the current difficult situation on the market, this can be considered not such a bad indicator. Especially when you consider that in November the total capitalization of the cryptocurrency market fell to $900 billion, although at the beginning of the month it was more than $1 trillion — and this is a drop of more than 10%.

Robot AAVEUSDT

In November, the cryptobot failed to bring profit to the team, it lost 5.726 USDT on transactions.

The reason for the failure is the collapse of the cryptocurrency rate, although before that all indicators showed its steady growth.

Robot ADAUSDT

In November, this robot brought the team 1.2319 USDT, which was a good indicator compared to other cryptobots. This month, the robot confidently bet on shorts, while longs were the most unprofitable, due to the fact that the growth of the exchange rate was difficult to predict.

We can say that ADAUSDT coped with the difficult market situation, and even a sharp drop in the cryptocurrency rate didn’t lead to losses.

Robot ALGOUSDT

In November, the cryptobot earned 3.75827 USDT on the Binance platform. This is two times less than last month, but given the atypical market situation, it is a good result.

There were even fewer deals than in October, and only one was profitable, this is a long at the beginning of the month. All subsequent orders were unsuccessful, mainly due to the chaotic movement of the cryptocurrency rate in a wide range.

Robot ALICEUSDT

In November, the loss of the cryptobot was 11.3179 USDT. However, if short positions were leading in terms of the number of unprofitable orders, then in total the robot lost even more on long positions, although there were few such deals.

To protect the robot, it is worth noting that in November the cryptocurrency exchange rate fell by more than 30% and could not recover by the end of the month.

Robot ATAUSDT

In October, the bot did not enter trades, but returned to the team in November and brought 5.9548 USDT. The bot was quite active, successfully earned both on longs and shorts.

Rest and additional optimization clearly benefited the robot, and it even successfully coped with a sharp drop in the cryptocurrency rate, which began in the second week of November.

Robot AVAXUSDT

In November, the crypto robot could not cope with the market situation, its loss was 44.2 USDT. It made only one deal, which in the end turned out to be unsuccessful.

The lack of activity of the robot indicates that it could not recognize any familiar pattern, that is, there are no similar movements in the cryptocurrency rate in the historical data. This doesn’t mean that the cryptobot is not optimized enough: there are several factors at once, among which the panic in the market played a key role.

Robot AXSUSDT

This cryptobot was the main reason for the failure of the AKRA Futures robots team in November, its loss at the end of the month was 98.14 USDT. Like the "colleague" discussed above, it concluded only one deal this month, opening a short position.

If you look at the cryptocurrency exchange rate for November on Binance, it becomes clear that after the closing of the transaction, it fell sharply and remained flat until the end of the month. During this period, the robot simply could not detect familiar patterns in order to offset the losses.

Robot DOGEUSDT

In November, DOGEUSDT performed well on the Binance exchange, earning 118.50042 USDT. It was quite active, confidently playing both longs and shorts, and worked out the fall in the cryptocurrency rate with a further flat, followed by periods of high volatility, without consequences.

DOGEUSDT, as before, shows the greatest activity due to the high popularity of the cryptocurrency pair among traders. It is large volumes of historical data that allow it to successfully predict the future course of the cryptocurrency, which is also complemented by perfectly optimized technical analysis tools.

Robot NEARUSDT

After trading successfully in October, NEARUSDT recorded a loss of 24.875 USDT. Although its activity when concluding transactions both in short and long (long) indicates that the robot did not experience problems with identifying patterns.

The reason for the failure is that at the end of the month, the cryptocurrency rate fell almost twice, causing panic among crypto investors. The panic, in turn, caused a massive conclusion of transactions in different directions, which provoked an atypical movement of the cryptocurrency rate.

Robot RUNEUSDT

After a major setback last month, the RUNEUSDT cryptobot recovered and brought 8.408 USDT. Although its trading activity was significantly lower than in October.

The bot made two successful trades in long for the whole month. It successfully found entry points: the first time it played on the rise in the rate before the fall, and the second time on rate’s correction after the collapse of the price of the cryptocurrency.

Conclusions

The corruption scandal with the FTX and its subsequent bankruptcy, as well as a sharp drop in the bitcoin rate, which all exchange players are still guided by, caused chaos and panic in the market. There were no similar situations on any cryptocurrency exchange in the entire history of cryptocurrency trading, so the analysis based on historical data turned out to be ineffective, and most of the patterns detected by the robots were incorrect due to the atypical behavior of traders.

Therefore, the improvement of algorithmic trading technology came in handy and made it possible to avoid the huge losses that many traders suffered in November both on the Binance exchange and on other centralized and decentralized crypto exchanges. In any case, the robots will use the experience gained in the future in trading, which will make their work more accurate and profitable.