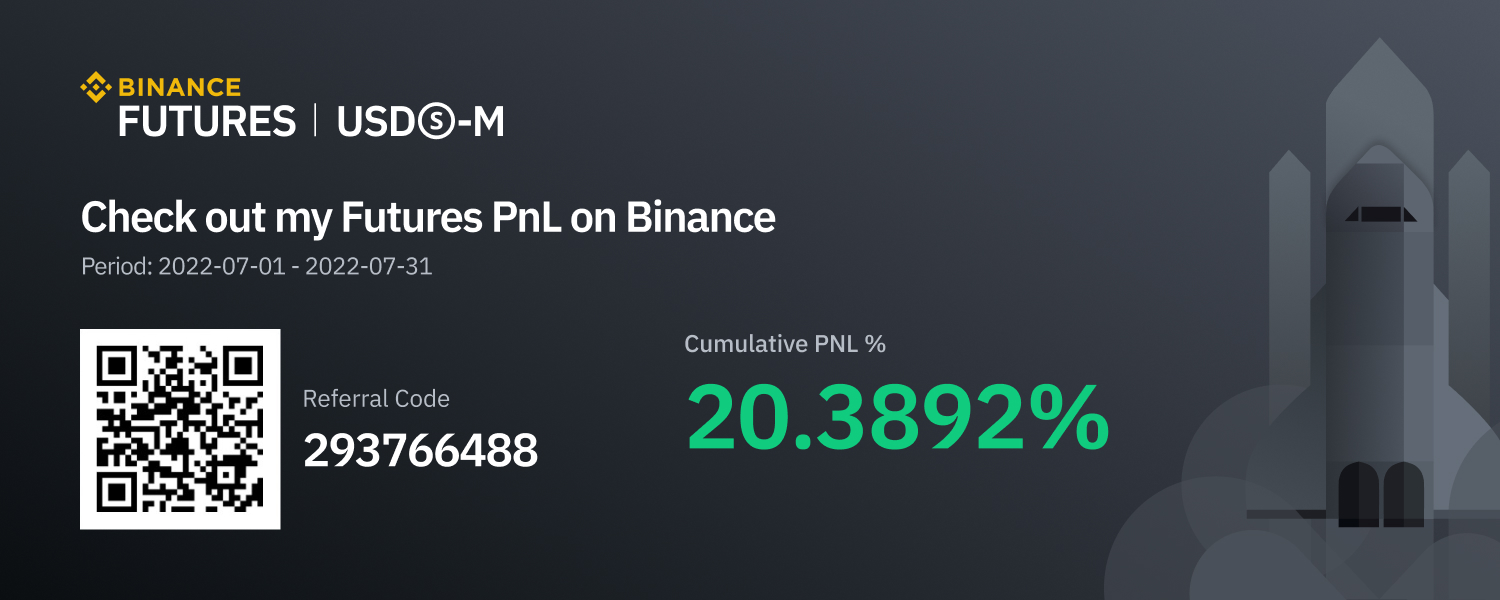

Hello! I am Alexander Glebov— the leading algotrader of the AKRA Futures robots’ project. AKRA Futures robots are robots for automatic cryptocurrency trading. The analysis of their work on Binance in June showed that they are able to adapt to difficult market conditions and price turns. July was a real test for robots. Although some trading robots lost money, the cumulative team PnL was 20.3892% in July, and it is a good indicator in exchange trading. I want to analyze in detail the result of each robot's work.

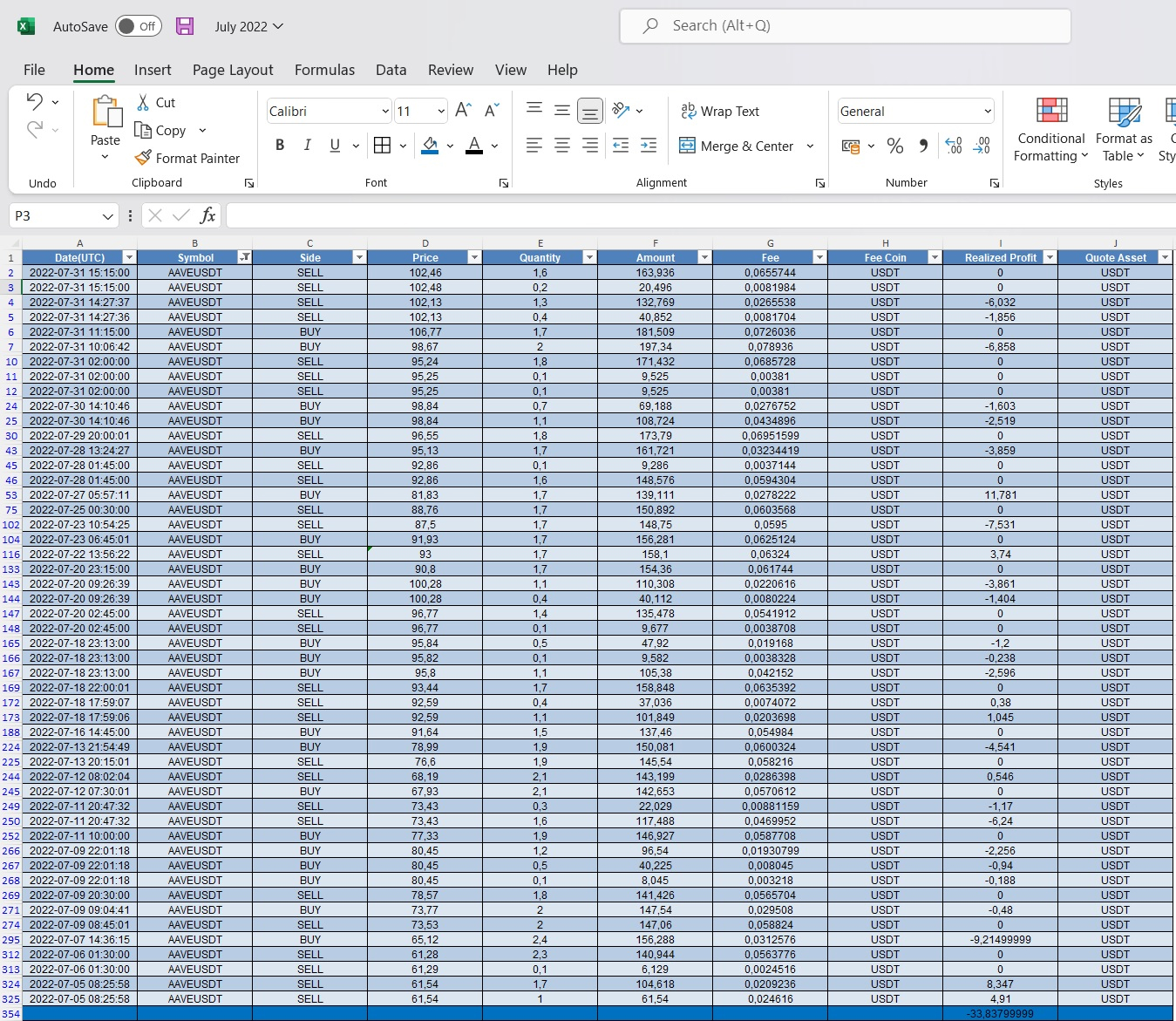

Robot AAVEUSDT

In June, this robot made a profit of 32.51200001 USDT; but in July it went into negative, its loss was 33.83799999 USDT.

Why? All negative transactions were recorded when the exchange rate of the cryptocurrency asset changed rapidly by more than 7%. Last month, the bot did an excellent job with 5% rate fluctuations and made a good profit from it. However, sharp rate fluctuations, combined with the bot’s caution, led to several rekts — it closed trades, protecting itself from an even greater loss.

It is necessary to wait for it to correct its algorithm and optimize for trading in conditions of high exchange rate volatility. On the other hand, such trading is riskier, and the basic imperative of our bots is the inadmissibility of risks. I don’t see anything critical here — everyone has failures.

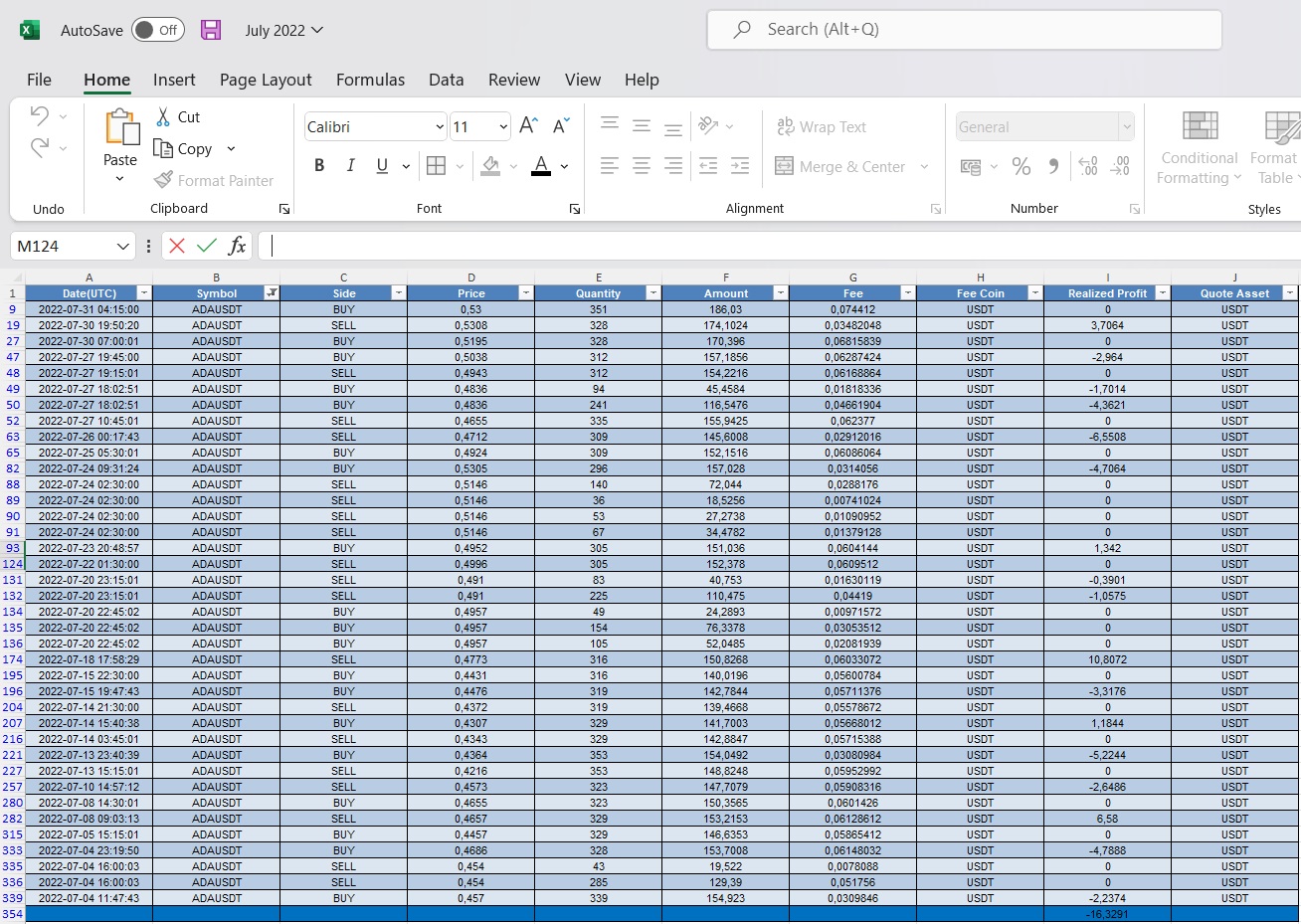

Robot ADAUSDT

In July, this robot worked in the negative, its loss was 16.3291 USDT. If we take into account last month's income of 15.6912 USDT, it actually went to zero at the end of two months.

Let's understand why it happened. On July 13, sharp fluctuations in the ADAUSDT exchange rate on Binance began. These were powerful intraday movements, neither a human trader nor a robot was able to respond adequately to them. The analysis also shows that the reason for the two losing trades was the sale of the asset during the moments of the bullish trend. Here, one of the indicators worked incorrectly, as a result, the bot could not correctly predict the price movement. Since the robot is self-learning, it remembered this error.

Considering that there was a chaotic movement of the cryptocurrency rate on Binance, the bot performed well, although it went into minus. In such market conditions, most traders and automated advisors usually bring the situation to a margin call and drain deposits by stop-out. ADAUSDT was able to get out, but it had a small drawdown.

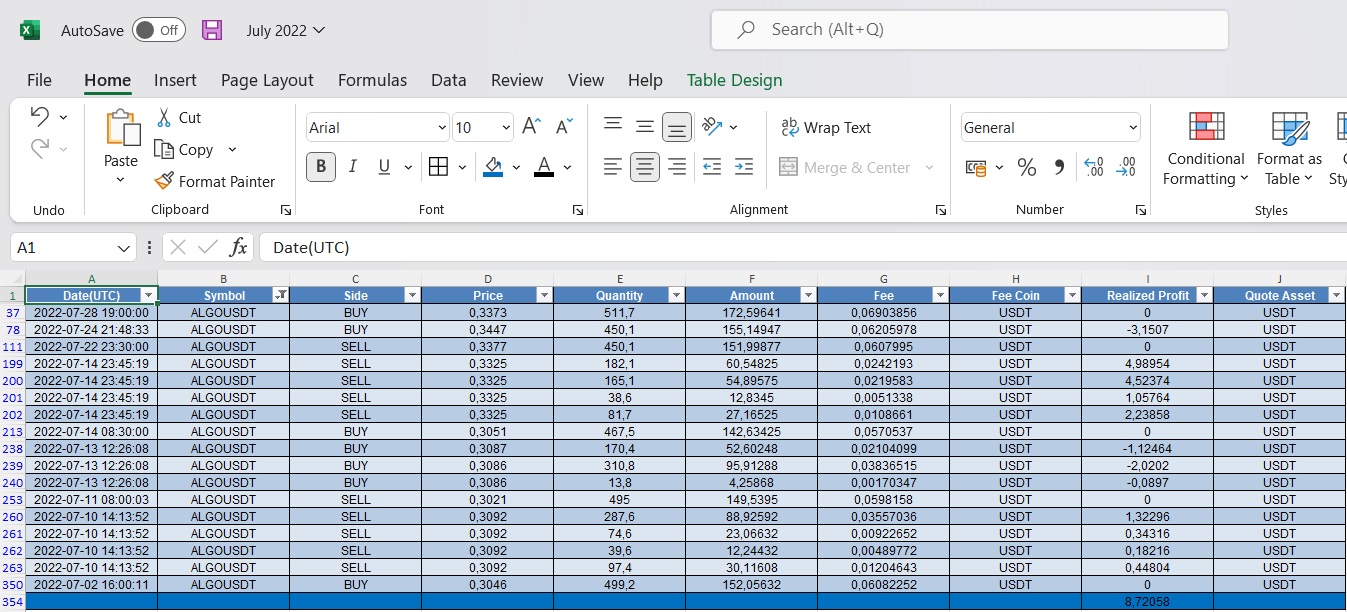

Robot ALGOUSDT

The bot took into account the mistakes for the previous trading period, and in July its profit was 8.72058 USDT. Although the trend, like last month, was unstable — it had a lot of upswings and chaotic movements between bears and bulls.

Despite the prevailing trend toward a rise in the asset price, all purchase transactions opened by the robot were unjustified, but all SELL orders were profitable. The bot entered orders during the trading day, although intraday trading was unsuccessful in the previous period.

We see that ALGOUSDT is really able to learn and adapt to the situation by changing trading algorithms. He was just a little short of getting into the plus for two months, but this robot will be able to show its best side.

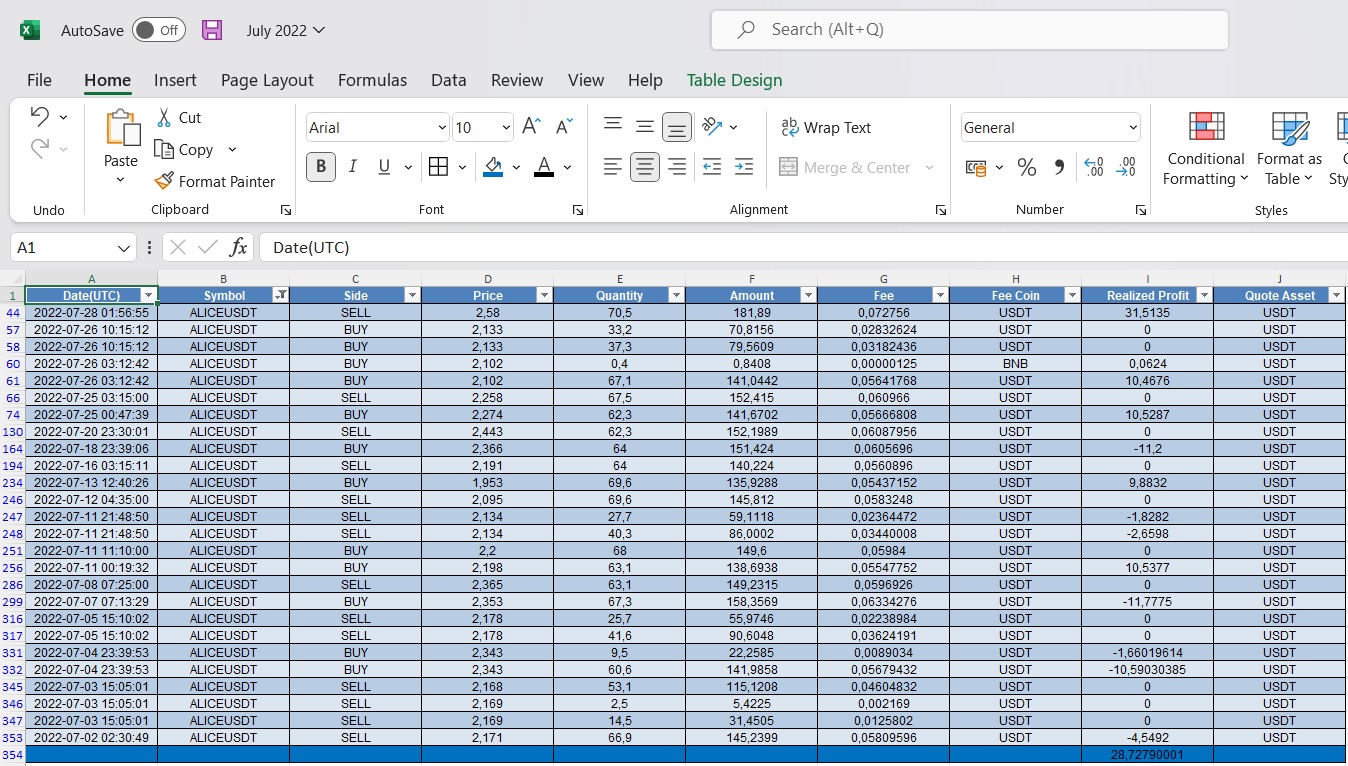

Robot ALICEUSDT

In July, the cryptobot worked much more productively than in June and showed a profit of 28.72790001 USDT. However, it caught several rekts. One rekt was necessary because the asset price did not reach the desired level for the entire period, and if the bot continued to hold the order, then at the end of the month it would go into negative.

Chart analysis shows that ALICEUSDT was able to adapt to trading in conditions of high volatility of the exchange rate, and it even turned some serious jumps in its favor. At the end of the month, he was able to hit the jackpot by betting on a correction of the exchange rate, which jumped by almost 20% in just a few days.

As for several major unsuccessful trades, their reason lies in incorrectly chosen entry points that occurred at the moments of the trend reversal. There is nothing to worry about, because robots effectively learn from their own mistakes.

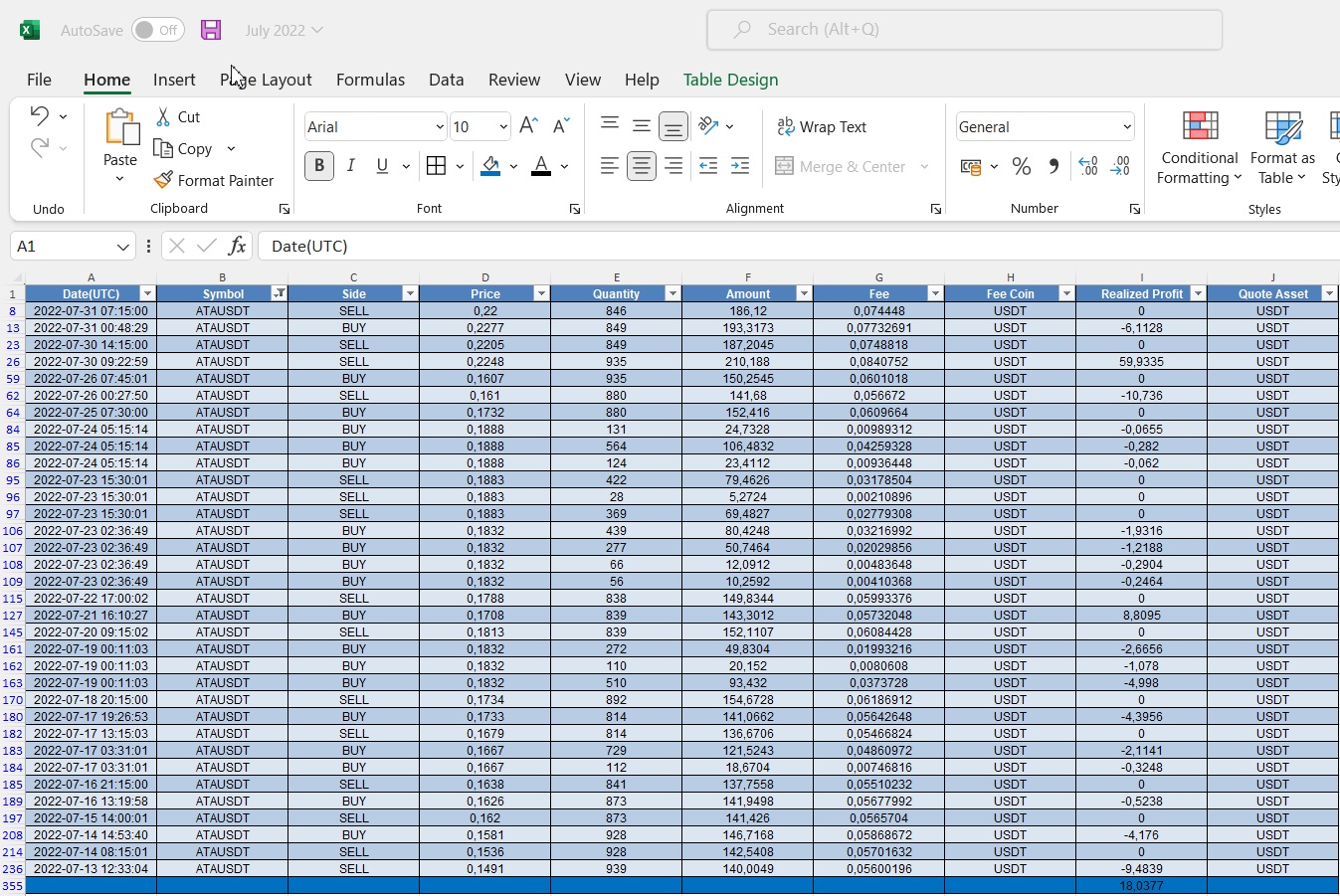

Robot ATAUSDT

In June, ATAUSDT showed above-average results on Binance, in July it continued the trend and made a profit of 18.0377 USDT. He made only two successful orders during the entire trading period, but their total profit covered all the failures.

Since the beginning of the month, the cryptocurrency pair has shown a steady bullish trend, only closer to the end of the period it made a sharp turn and then adjusted. The cryptobot played exactly on the correction. It found the perfect entry point and fixed the profit in time before the price reversal.

Based on a series of unsuccessful trades, it can be concluded that ATAUSDT still does not adapt enough to intraday trading during flat periods and closes transactions based on erroneous patterns. But we can see improvements in the program compared to the previous month.

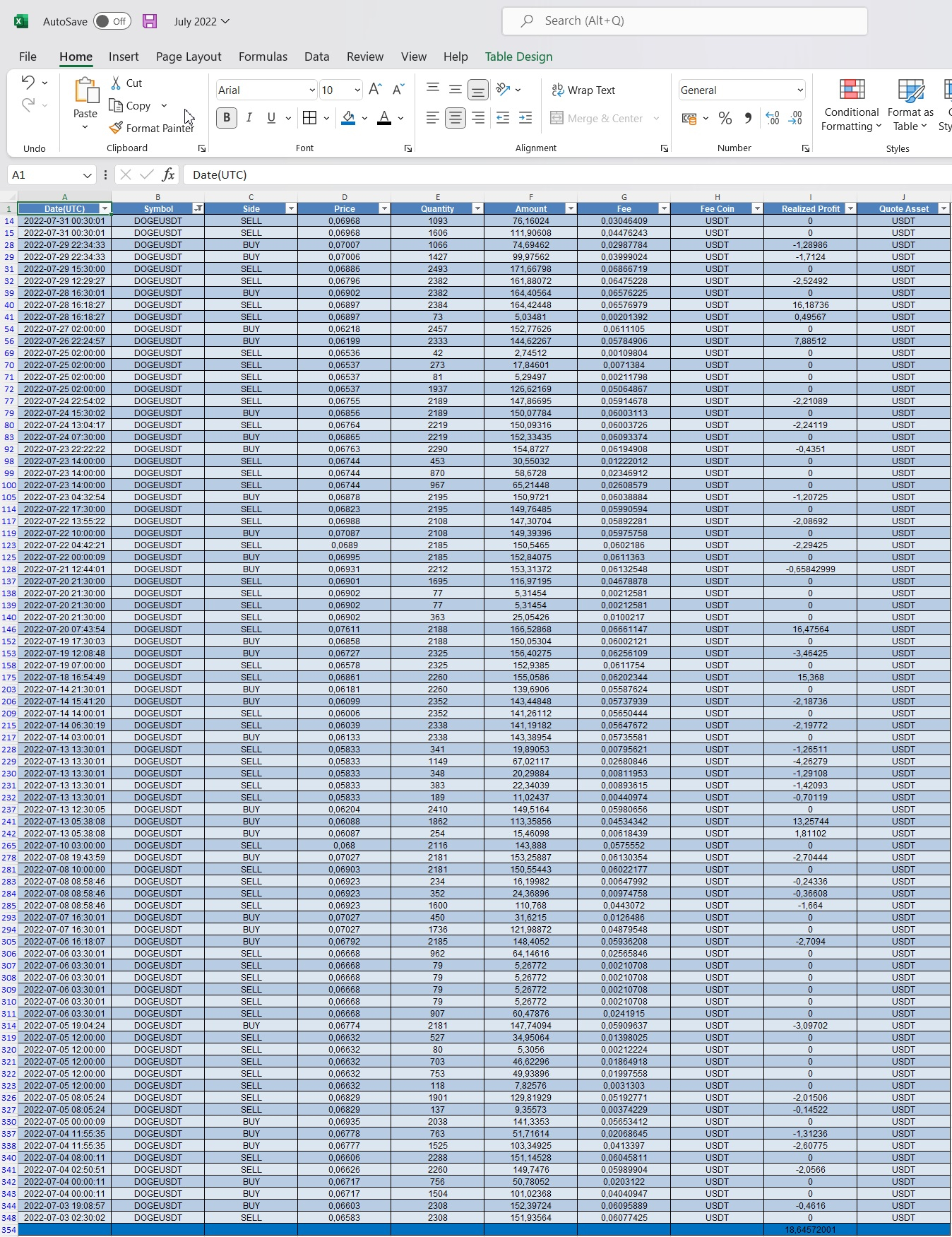

Robot DOGEUSDT

In July, the cryptobot was twice as productive as in the previous period and made a monthly profit of 18.64572001 USDT. In a month, it found 84 entry points, although not all of them were successful. The cryptocurrency exchange rate was relatively stable this month, sideways movements prevailed. In such conditions, even professional traders often make mistakes, but the bot coped very well.

Compared to last month, the cryptobot's trading algorithm has improved, although some errors in the analysis still occur. For example, in the middle of the month, he received a whole series of minuses at the moments of drawdown, although in the medium term the chart showed a clear bullish mood.

It is important to note that the DOGEUSDT cryptocurrency pair (due to its popularity among traders) trades relatively smoothly: without swings, reversals or corners. Therefore, the profitability of trading should not be based on luck, but on accurate mathematical calculation and thorough technical analysis based on several tools. Our bot has it.

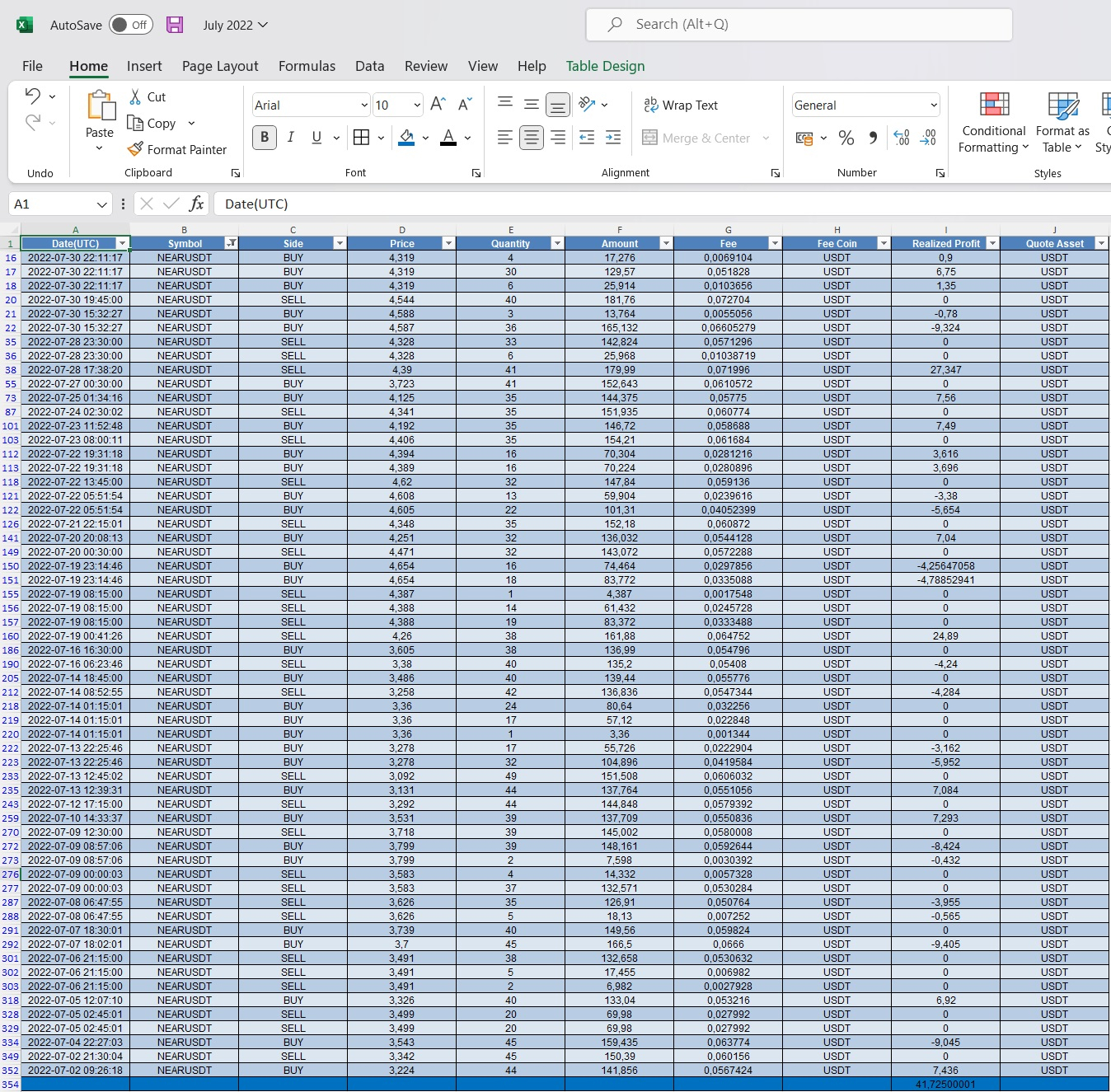

Robot NEARUSDT

The bot improved its past performance and in July reached a yield of 41.72500001 USDT. It is a very good result, especially considering that in the second half of the month the rate of the cryptocurrency pair jumped by 30%. The robot was able to quickly rebuild, catch the trend and even hit the jackpot on the growth of the cryptocurrency.

Approximately equal number of successful and unsuccessful orders indicates that the bot adheres to a trading strategy based on minimizing risks. He is quite active during periods of high volatility of the exchange rate. It means that it has enough input data to conduct technical analysis and identify patterns.

Of course, the NEARUSDT trading strategy on Binance is still far from perfect. However, there is no reason to interfere with the robot's algorithm and stop it — let it continue to learn independently. Bot does it well.

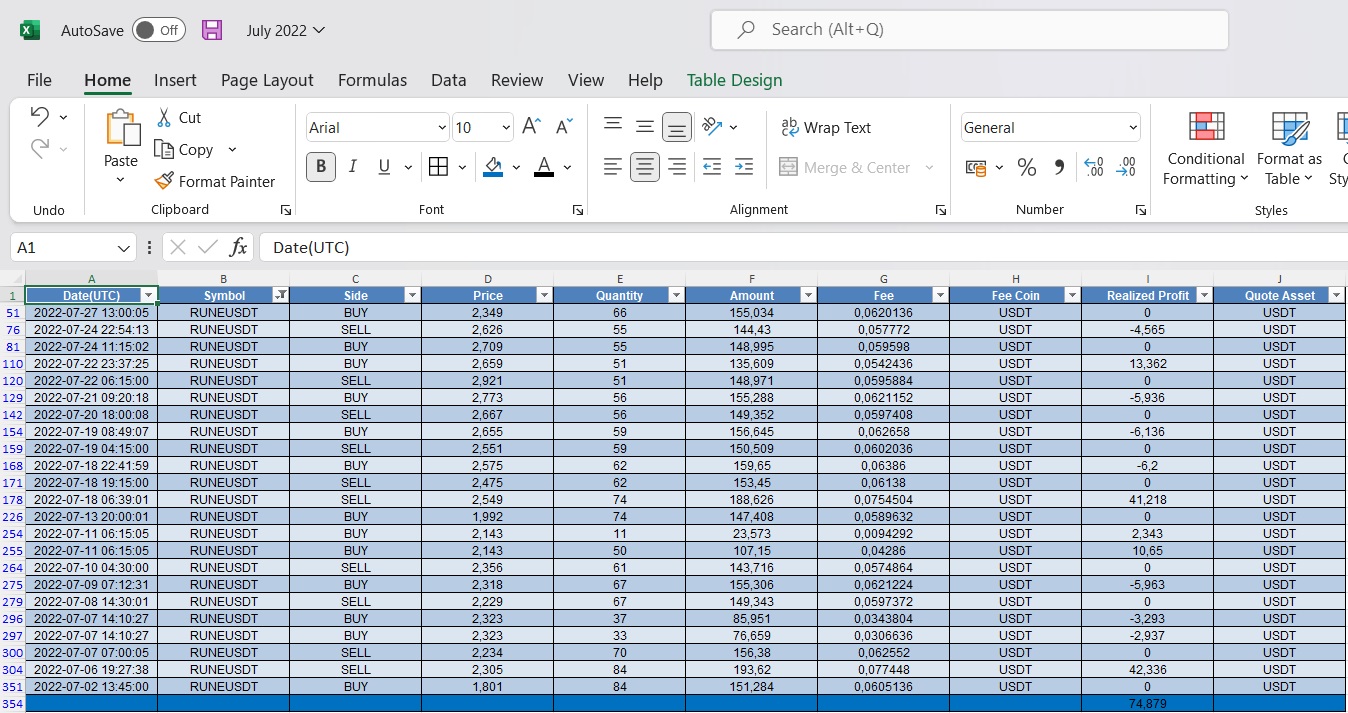

Robot RUNEUSDT

This bot almost doubled the previous record of profitability and in July its result was 74.879 USDT. Although the cryptocurrency rate jumped quite seriously, sometimes reaching 40%. Because of this, many traders who trade cryptocurrency themselves have lost part of their deposits.

The cryptobot worked perfectly on the swing — it entered into the deal at the very moment of the reversal and hit the jackpot twice. But the loss on transactions was recorded at the moments of sideways movements, when the trend was unclear and the robot could not draw understandable graphic figures.

In July, RUNEUSDT performed well, although its activity was average. There are some minor drawbacks in trading during flat periods, but the peaks were worked out perfectly. It behaves like a real scalper.

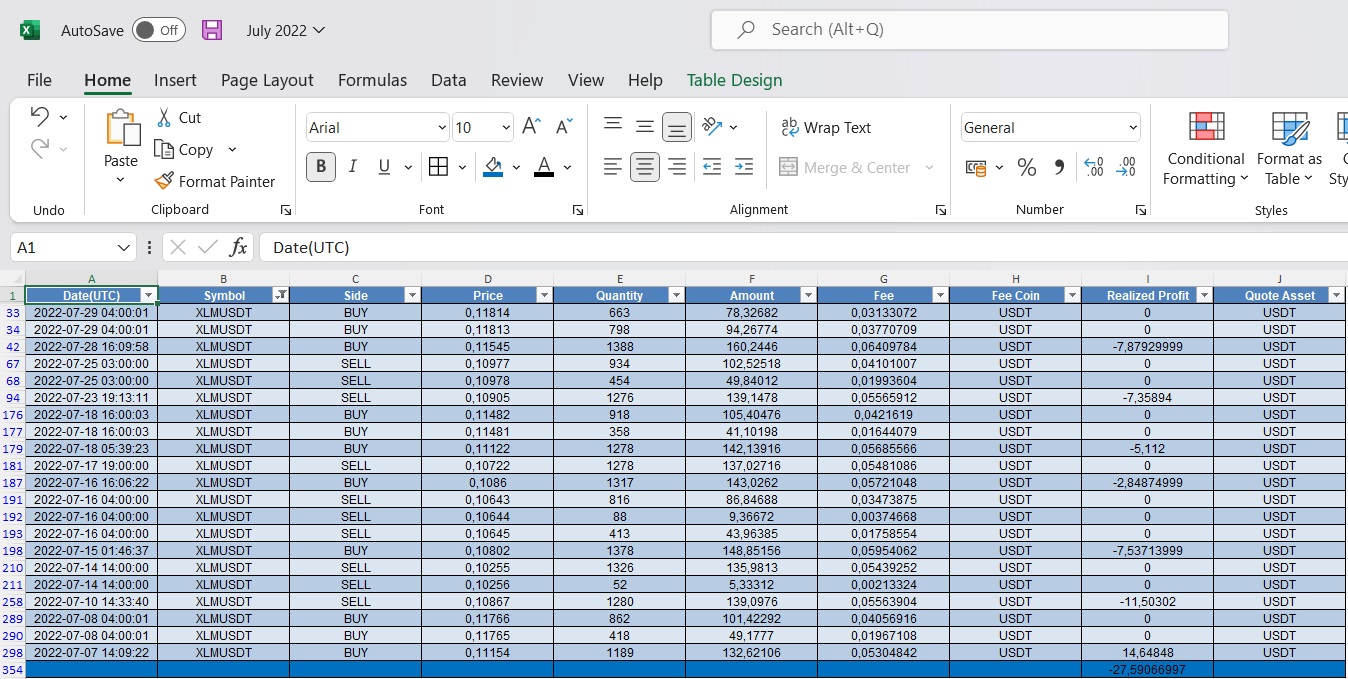

Robot XLMUSDT

July was a major failure for this robot, its loss was 27,59066997 USDT; although in June it had an average yield. It made only one successful transaction. At the same time, the volatility of the cryptocurrency pair was even lower than last month.

Basically, the chart showed only flat movements without sharp jumps and bounces. In such market conditions, it is almost impossible to build a reasonable support−resistance level chart. The moving average also brings little benefit, so trading becomes unpredictable.

It's too early to talk about insufficient optimization of the bot. The passivity of crypto traders on this cryptocurrency pair was the main reason that the robot could not find any familiar pattern. Mistakes are also important for training a bot — analyzing them will help it optimize much faster.

Conclusions

In July, the bots worked well on Binance and gave a profit that exceeded the profit level of PAMM accounts of classic exchanges. Of course, there were successful and unsuccessful transactions, some of the robots went into negative, but it is the advantage of teamwork.